Two simple tips on tax savings over holiday season | Tax | Money Savings

Holiday season is around the corner folks! The mood is festive, the gifts are flowing, the music is playing and the lights are growing. Yes, it indeed a very jolly good time of the year. But while this moment lasts for a short time for you, it happens to continue for a very long time for the TAXMAN! He is jollier than Santa, hohoho!

Cause in only four short months (i.e. in just 120 days or 17 weeks) it’s the great Canadian tax filing date! For all those lovely merry folks who will have taxes due to the taxman in a few months, it means the possibility that you may not be able to pay your taxes in full at once and thus incur the very interesting charges. Yes folks! Indeed this is why the taxman is hoping you continue splurging on gifts this season.

Stress not. Review these following two simple tax savings tips now and start planning ahead of time and reap the benefits in a few months by potentially banishing the very interesting charges payable to the taxman.

Money Savings #1 simple tip on tax savings over holiday season

Image courtesy of Stuart Miles / FreeDigitalPhotos.net

Most people know that making charitable contributions results in tax savings. Most don’t know how much savings though.

For every dollar donated to a sum (less than or equal to) <= $200 = 15% tax credit

For every dollar donated to a sum (over) > $200 = 29% tax credit

And this is just Federal credits. Once you add in Provincial credits on donations, the tax saving magnifies further.

Knowing this mathematical formula is not enough though. The key is in the implementation, and this is where most Canadians get it wrong:

- Claiming it each year – You don’t have to claim your yearly donations in that year. You can accumulate donations for up to 5 years and claim together in the year you expect that your taxable earnings will be high.

- Not holding on to your receipts – Always keep records of taxable receipts. In this digital era, there is no excuse for not having a copy of the receipt easily accessible. Print it, scan it, email it, but just SAVE IT.

- Forgetting to combine family donations – In Canada, every tax return is for the individual. However, donations made by the entire household can be allocated to the highest income earner in the household to reduce taxable earnings.

- Hospital lotteries mistakenly assumed as donation – But sadly they are not! Yes, it seems like win-win to buy one of these – Chance to win that fabulous house, boat, sports car etc. shown on the mailer and get a taxable deduction at same time! Sorry! Not happening. So before donating, always ASK if the contribution is 100% tax-deductible in Canada.

- Any charitable organization is eligible for deduction – NO! Only charities registered within jurisdiction of Canada are eligible for deduction on tax return. Often times during global crisis events, there are calls for donations for restoration aid efforts. However, most often these organizations are internationally based thus not qualifying for Canada tax deduction purposes. By all means do donate to aid efforts if you wish to, but just be aware of the above point. Alternatively, you can seek out a Canadian registered charity that is accepting donations for the same relief effort and donate to it while maintaining eligibility for deductions.

Money Savings #2 simple tip on tax savings over holiday season

Image courtesy of Renjith Krishnan / FreeDigitalPhotos.net

Instead of spending on the usual splurge on gifts this season why not use for medical and healthcare purposes. Agreed, the latter is not exciting as mall shopping with the family and girlfriends, but who says “medical shopping” has to be boring. There are several procedures and treatments that fall in the grey area of cosmetic and aesthetic while being officially recognized by Canada Revenue Agency as medical procedures eligible for tax deductions. For a list of all eligible procedures click here.

Now here are some important things to remember about medical claims:

- Only the amount in excess of 3.0% of your Net Income for the taxable year is eligible under this category. Furthermore, this pertains to non-reimbursed medical claims. No double dipping, right. So most people do not reach the 3.0% threshold since majority of the medical claims not covered under provincial health plans are usually reimbursed by your supplementary group insurance plan. However, with the latter, there is the factor of “loose change” that most people forget to take in to account. Will get to it in a moment.

- Medical expenses should be pooled together as a family to maximize the credit available.

- Claim it on the lowest income earner in order to reach the threshold easily.

- Your medical reports and statements are easily available to you from your doctor’s office and from pharmacists. So all you have to do is make a quick call to each location and ask for the annual visitation/treatment/prescription summary that they can easily print out for you.

- Purchase of medical insurance is claimable expense. This includes Travel Medical Coverage as well.

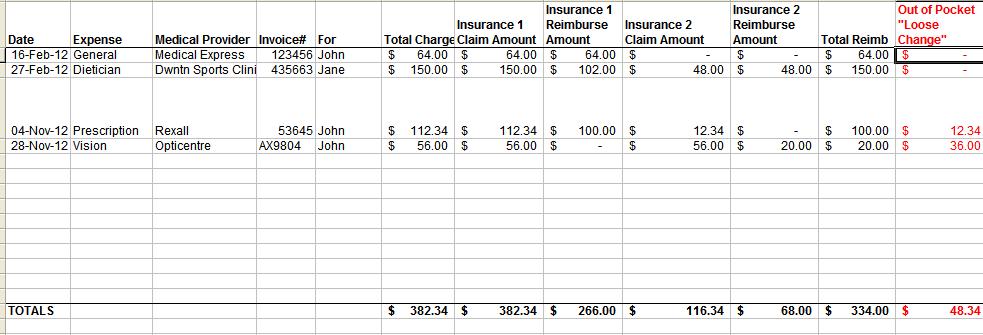

- Now back to the “loose change” factor I previously mentioned. One of the biggest challenges I have personally faced when submitting claims to my insurance companies is the coordination of benefits. Have you felt the same? For those not familiar with this term, what it means is coordinating your claims between your primary insurance provider (usually the plan with your employer) and the secondary provider (your spouse’s plan if you are included on it) and vice versa for your spouse. God knows how many claims I have forgotten to send to the secondary provider after I receive the statement from the primary provider. And most importantly, since there is always a deductible in most plans, there is usually an amount, typically a small amount, that is left over after both insurance providers have paid your claims. For a household with several medical claims, these small non-reimbursed amounts or “loose change” add up.

- While most providers have websites where you can easily access your annual claim statements, it is still a chore trying to reconcile what was paid to whom and what is unpaid now. Would it not be easy if there was a very easy way to manage your coordination of benefits so you can track the “loose change” and be able to claim it on your tax return? Well, folks I have prepared a very simple excel spreadsheet just for you so you can now keep track of this “loose change” and never have to worry about unclaimed non-reimbursed medical expenses. You can download it by clicking the image below. It should be self-explanatory but if you do need any help, drop me an email.

Happy Holidays, folks!

This list is compiled based on my discussions with a tax adviser at H&R Block Canada who has sponsored this blog post. The information provided here is a general list for information purposes. Taxes vary among individuals so always consult a tax professional for certainty. I invite you to visit hrbtaxtalk.ca to view tax queries posted by others or post your own question. Therefore, no responsibility for loss occasioned by any person acting or refraining from action as a result of the material contained in this bulletin can be accepted by H&R Block Canada, Inc. or Larkycanuck.com

Thank you for taking time to read this. Blogging is a labor of love. Reader donations in the form of comments or sharing on other social media channels below are much appreciated.

Related Posts

Category: Money Saving Tips, Tax

Comments (6)

Trackback URL | Comments RSS Feed

Sites That Link to this Post